Grain Report Wednesday - 12th November

- Clear Grain Exchange

- 1 day ago

- 1 min read

What price do you want for your grain?

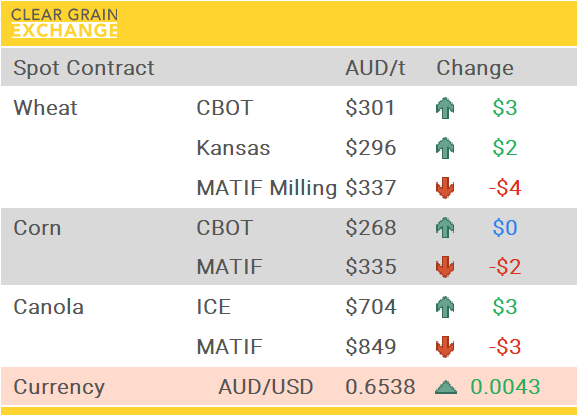

Australia’s independent grain report—designed to help support your pricing decisions before the market opens at 10:00am AEST. If you need to change your offer price, simply edit it before market open.

Grain markets were in limbo overnight waiting for China to start purchasing and uncertain about how the USDA will assess corn and soybean yields in their report on Friday night.

BOM rain for eastern seaboard in the next week has local markets wary.

$A slightly lower but no real conviction either way. The lack of official data out of the US has markets wary, with private data suggesting the need for the US Fed to be more aggressive with rate cuts.

Track sorghum values into Newcastle have lifted $6/t in recent days to $312/t and might signal the start of some positioning by traders as crop prospects improve on forecast rain. GM canola values pinged higher up $10-15/t to $690/t into WA ports. Most grains had a slightly firmer tone, most likely due to slow farmer selling with traders buying selectively at depots hoping to establish positions (higher protein) which they can trade around.

For further market commentary please contact the CGX team on 1800 000 410

CGX operates igrainX for grain on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments