Grain Report Monday - 10th November

- Clear Grain Exchange

- 3 days ago

- 1 min read

What price do you want for your grain?

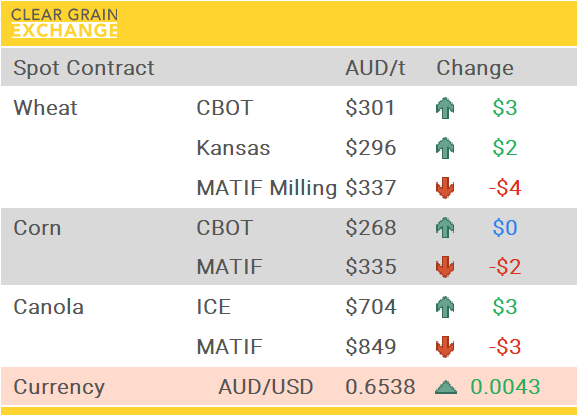

Australia’s independent grain report—designed to help support your pricing decisions before the market opens at 10:00am AEST. If you need to change your offer price, simply edit it before market open.

Bean prices firmed on bargain-buying bounce as traders assessed prospects for more US sales to China. Wheat fell on the smaller-than-hoped recent US sales to China, with the focus returning to large global supplies. Corn was little changed but faced headwinds from larger supplies as harvest approaches completion.

BOM there has been rain through CQ and through the Downs down to south-east QLD. Rain is predicted for much of northern Australia and right through the eastern seaboard in the next week. There is moisture about which is pointing to a protracted, delayed harvest.

$A remains trapped, supported by prospects of improved interest rate differentials but pressured by wavering global risk sentiment.

Not much more to say. Internationally, this week we will be looking at the USDA reports and any signs of volume Chinese buying. Locally, there may be some opportunities for some sales of old crop into local delivered end user markets at a premium with the rain forecast likely to have sellers holding tight.

For further market commentary please contact the CGX team on 1800 000 410

CGX operates igrainX for grain on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments