Weekly Grain Traded CGX - 20 October

- Clear Grain Exchange

- Oct 21

- 4 min read

Grain stored on-farm can now be sold on CGX

Old crop prices above new crop - Domestic users and exporters with early slots are covering grain, though buyers are more patient on new crop bids.

Market is now open for new season pricing - 2025/26 season grain can now be offered for sale on Clear Grain Exchange and igrainX.

CGX and igrainX enable growers to offer grain for sale - Growers delivering to warehouse can offer grain for sale on CGX. Growers with grain on-farm can offer grain for sale on igrainX and determine pickup/delivery timeframes.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

Market stats for last week

27 buyers purchased grain on CGX - more were searching for grain

15 in QLD and NSW

10 in VIC

3 in SA

10 in WA

65 sellers sold grain through CGX across 84 transactions - more were offering grain for sale

6 agent and/or advisory businesses sold grain on behalf of growers

20 different grades traded

6 commodities - Wheat, barley, canola, lupins, maize, oats

8 port zones traded across QLD, NSW, VIC, SA and WA

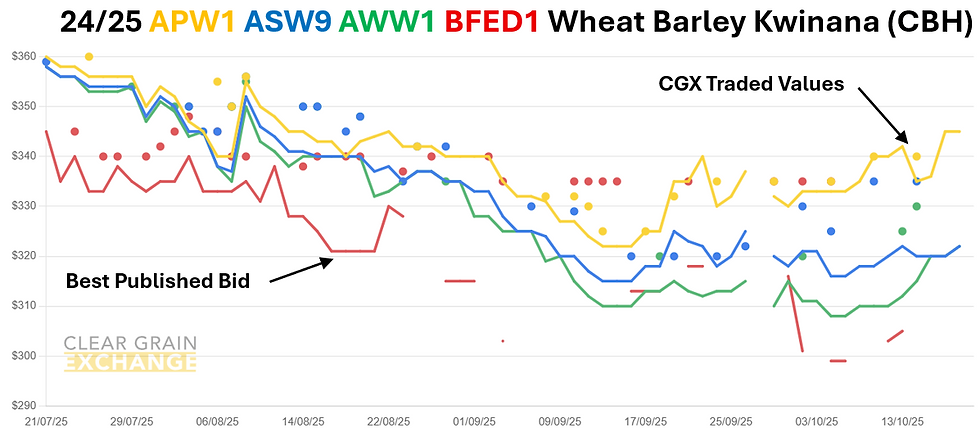

Buyers covering but published bids lag

New crop grain markets are maintaining a wide bid-offer price spread resulting in thin trade generally around Australia.

Old crop prices for last year's grain are trading at stronger prices than bids for new crop ahead of the coming harvest.

The better prices for old crop are coming from domestic buyers requiring more cover before harvest, particularly in dryer parts of south eastern Australia, and exporters with early shipping slots looking to get some grain on their books.

Bids for new crop remain lagging however as buyers expect reasonable crops in enough areas to anticipate possible downward price pressure due to grower selling.

Some buyers are also still getting organised with their supply chain costs for exports and other uses before being ready to bid consistently for new crop grain.

International physical grain prices continue to trade mostly sideways with reports of ample near term supply weighing on prices and conversely a tighter outlook for ending stocks at the end of the marketing year, along with slower exports from the Black Sea, supporting prices.

Hence both global and Australian based buyers are becoming more focussed on how Australian growers will sell their grain.

If Australian growers sell a lot of grain quickly when headers get rolling in earnest, it will pressure prices lower. If Australian growers offer their grain for sale at prices as they deliver, it will help to stabilise prices. Old crop prices trading above new crop prices currently are a good example of this.

Growers can help avoid downward price pressure at harvest by offering grain for sale.

Australian grain is needed by the world and international buyers are turning their attention towards Australian price expectations.

The opportunity for Australian growers is to show them prices they would sell for as early as possible to help impact those price expectations.

If you’re close to harvest, comfortable some of your production is assured, and know you will sell grain during harvest to generate cashflow, now’s the time to offer some grain for sale for all buyers to see.

There are plenty of buyers for Australian grain, make it easier for them to try and buy your grain.

Traded prices through Clear Grain Exchange that had corresponding published bids last week averaged $23.07/t above best published bids advertised from buyers.

Some trades were as high as $60/t-$70/t above best published bids. There are plenty of other examples, login to your online Clear Grain Exchange account to have a look.

It is so important for growers to OFFER grain for sale at their prices, rather than looking for buyer bids to be advertised and reacting to them -be proactive, take control, and offer.

Last week 20 grades of wheat, barley, canola, lupins, maize and oats traded with 27 buyers purchasing and 38 buyers bidding for grain. 101 buyers made 3,663 searches for grain offered for sale.

Growers are impacting the price of Australian grain by offering grain for sale and leading bids higher.

The more grain offered for sale, the more buyers will search for grain and the bigger say in prices growers have.

The intent of the exchange is to make it as easy as possible for growers to set prices and as many buyers as possible try to buy it, whilst securely protecting all parties.

That's how you create demand for grain and establish your grain's true value.

The prices traded through the exchange at a port track (eastern states) or FIS (in WA) level are provided below, but if you're reading this email you will have your own CGX account so login and use it to see what's trading, what's offered, and what's being bid at sites to help you determine the value of grain in your area.

Please call the CGX team at anytime for assistance on 1800 000 410.

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrainx market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments