Weekly Grain Traded CGX - 08 April

- Clear Grain Exchange

- Apr 8, 2024

- 3 min read

CGX now own and operate the igrain market for grain stored on-farm

Grain prices maintained their general improvement - Buyers were continuing to seek some coverage and growers were firm on price targets to sell.

37 buyers met grower target prices to purchase 46 grades - Wheat, barley, canola, faba beans, lentils, lupins and oats traded in 14 port zones.

CGX and igrain enable growers to offer grain for sale - Growers delivering to warehouse can offer grain for sale on CGX. Growers with grain on-farm can offer grain for sale on igrain and determine pickup/delivery timeframes.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

Grain market statistics for last week

37 buyers purchased grain on CGX - more were searching for grain

13 in NSW and QLD

17 in VIC

11 in SA

17 in WA

253 sellers sold grain through CGX across 365 transactions - more were offering grain for sale

15 agent and/or advisory businesses sold grain on behalf of growers

46 different grades traded

7 commodities - wheat, barley, canola, faba beans, lentils, lupins, oats

14 port zones traded across QLD, NSW, VIC, SA and WA

Prices maintain recent improvement

Australian grain prices maintained their recent general improvement last week with buyers seeking some coverage and growers holding firm on price targets to sell.

This has seen a general lift in prices of most grades, with traded prices on Clear Grain Exchange regularly better than published bids as a result of buyers meeting growers price expectations when they want to buy the grain.

Price differences for the same grade between port zones remain wider than you may usually expect in seasons where all states are pricing off the world market.

For example, APW1 wheat traded $381/t Kwinana, $348/t Newcastle, $337/t Pt Adelaide and $325/t Melbourne. At these numbers Melbourne is priced below other parts of Australia on a "natural price spread" basis, reflecting the real costs of execution into Australian offshore markets.

There were similar examples of other grades trading at price spreads wider than the natural price spread would suggest, particularly in port zones that don't centre around the capital cities.

This is likely to be a good example of the influence growers have on grain prices. If buyers don't know grain exists in your area, and indeed what price you want for it, it makes it difficult for them to buy it and manage their risk.

This can result in them "checking out" of your port zone, or being no longer willing to participate to put a trade together, particularly in the port zones with less domestic demand.

Growers can influence demand for their grain directly, by OFFERING it for sale. This way ALL BUYERS can see it and remain interested in trying to buy it!

The Clear Grain Exchange stats show the port zones with the highest amount of grain offered for sale, generally have the highest number of buyers trying to buy that grain, and are achieving the best prices relative to other port zones.

The good news is there is no downside in having your grain on offer. It costs nothing to have a CGX account and nothing to have your grain offered for sale, plus you're anonymous at all times.

You can edit or cancel your offer at anytime before it sells and if it sells you retain title of your grain until you're paid with CGX's secure settlement.

There is so much value to be generated in the simple act of growers "OFFERING" their grain for sale rather than accepting published bids.

Many prices have improved in recent weeks

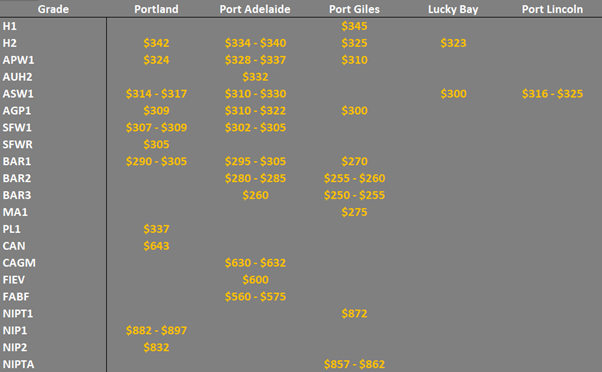

A summary of what traded on CGX last week is provided in the charts and table below. See more prices of what traded by logging in to your CGX or igrain accounts.

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrain market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments