Grain Report Wednesday - 10th September

- Clear Grain Exchange

- Sep 10

- 2 min read

What price do you want for your grain?

Australia’s independent grain report—designed to help support your pricing decisions before the market opens at 10:00am AEST. If you need to change your offer price, simply edit it before market open.

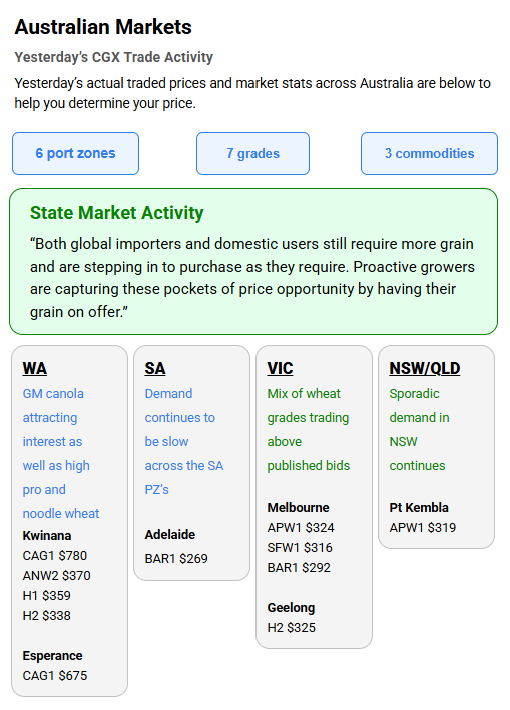

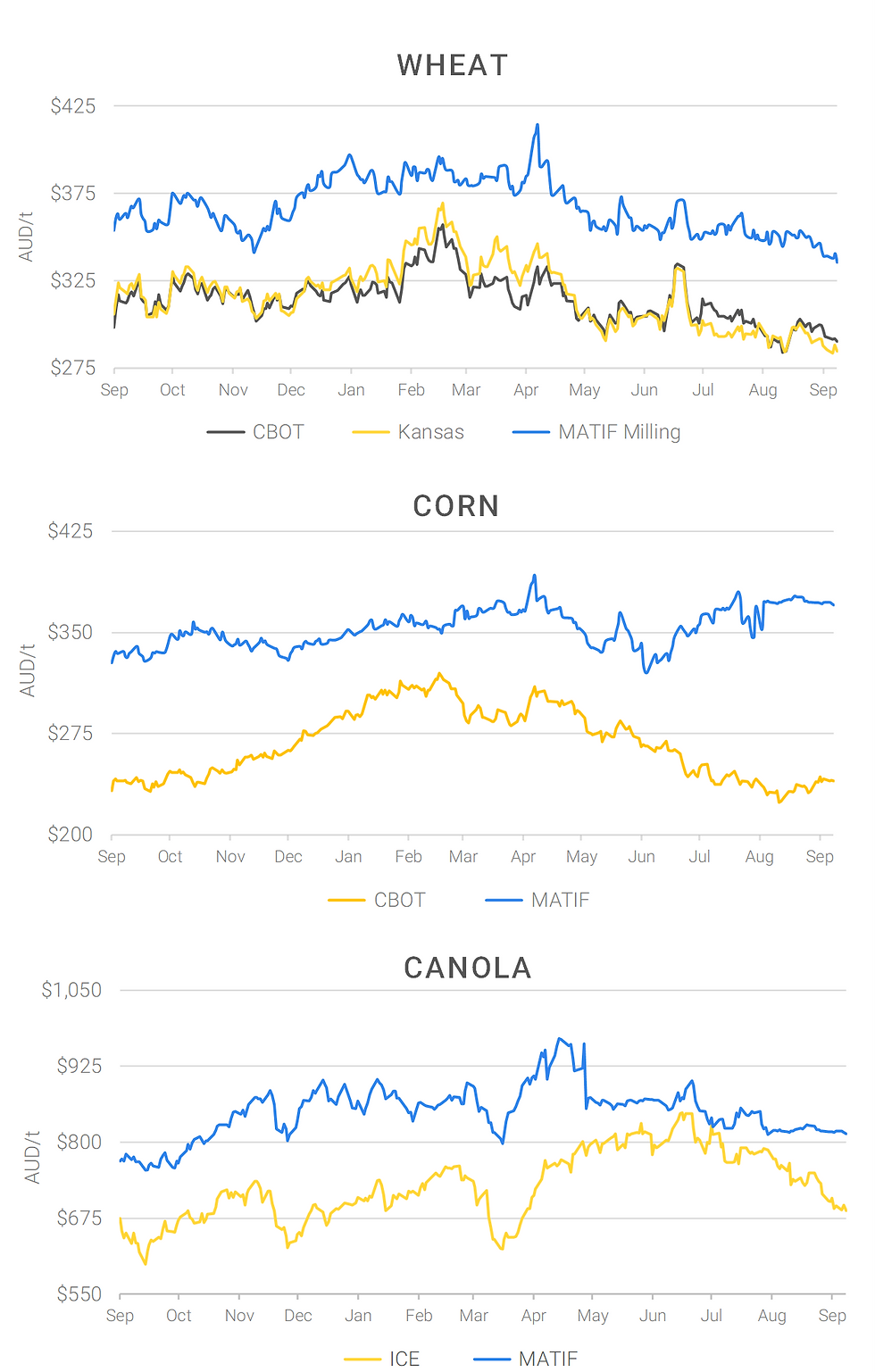

Grains were lower everywhere overnight as traders’ position for Friday’s USDA S&D report. The trade is estimating 25/26 US corn end stocks at 2 billion bushels (bbu) vs 2.1bbu last estimate (2.3-1.8bbu range) and up 50% from 1.3bbu in 24/25. Wheat ticked down on falling Russian wheat export prices on a step up in grower selling and on limited import demand.

BOM rain moving into the NSW south-west and Riverina today after good falls through north-western and central areas overnight. Most of the south-east cropping belt is likely to receive rain over the next few days.

The best chance for a change in market sentiment will come from the USDA lowering projected US corn yields this week. We should get a good idea of what we are up against in the next few weeks with clear dry weather in the US expected to quickly accelerate US corn harvest pace. Otherwise, most indicators look negative for nearby markets with Russian selling increasing and local crop prospects improving which may start to encourage an increase in local selling.

Please let me know if you would like me to cover anything else in these reports.

Local market liquidity will pick up into harvest and create some more dynamic pricing.

For further market commentary please contact the CGX team on 1800 000 410

CGX now operates igrainX for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments