Grain Report Tuesday - 20th December

- Clear Grain Exchange

- Dec 20, 2022

- 3 min read

Our goal is to help growers and their agents determine the selling price for their grain by providing relevant price discovery each day. Check out the moves in overnight international markets and yesterday's actual traded prices across Australia. There's also market commentary giving context and comparisons to prices of international physical markets. If you need to change your offer price, simply edit it before market open.

What price do you want for your grain?

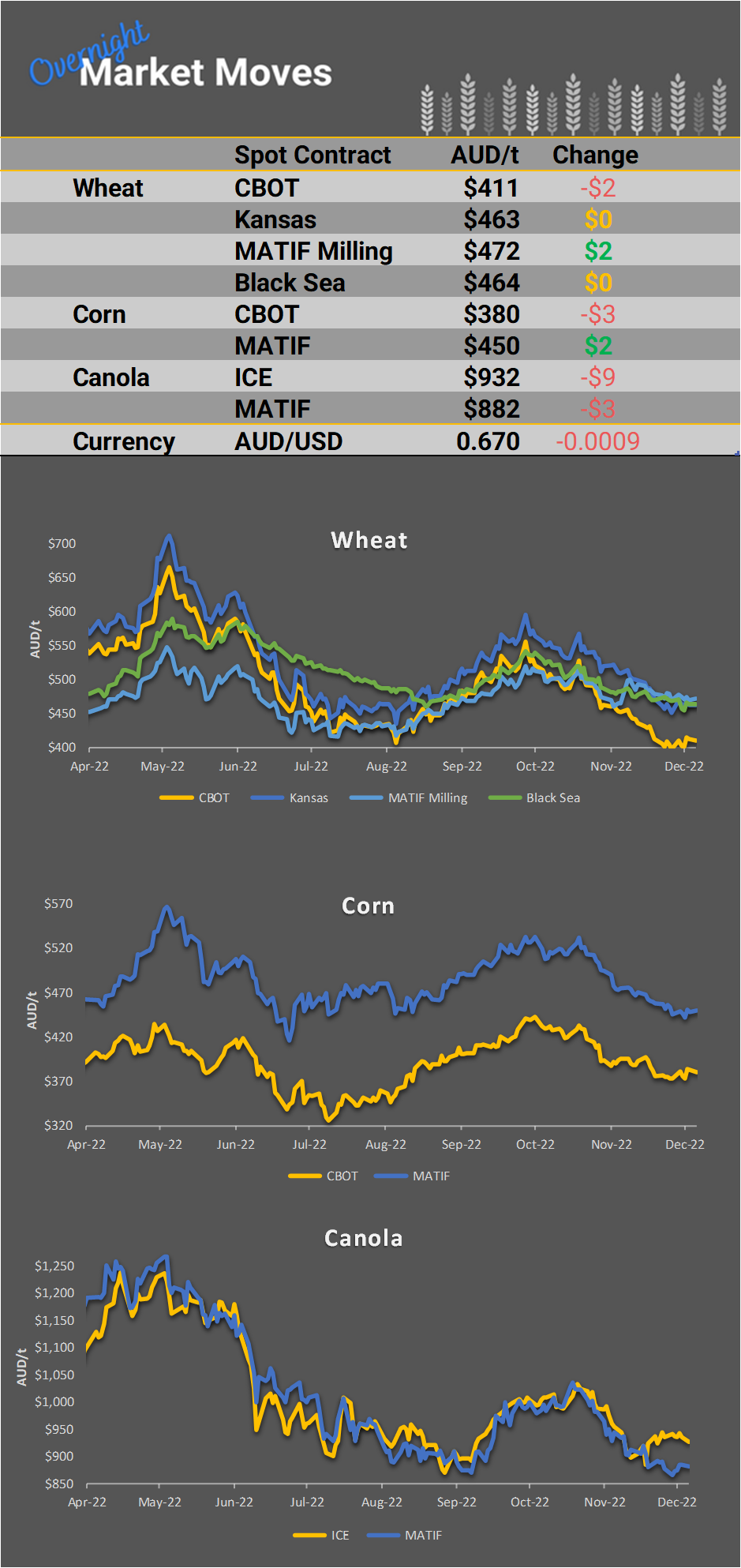

All markets with red dials last night, although Kansas wheat was barely unchanged.

Concerns in the US that 20% of the winter wheat area could be susceptible to winter kill.

The area of concern accounts for 45% of the Hard Red Winter crop.

Every year we tend to kill the US crop over the Dec – Jan period with winter kill.

Ukraine grain area is estimated to be 8.7 million hectares for the 2023 season, down 22% from last year and down almost half since the invasion.

But what is more concerning is Ukrainian growers plan to use less fertilizer due to lack of finance, which will impact yields.

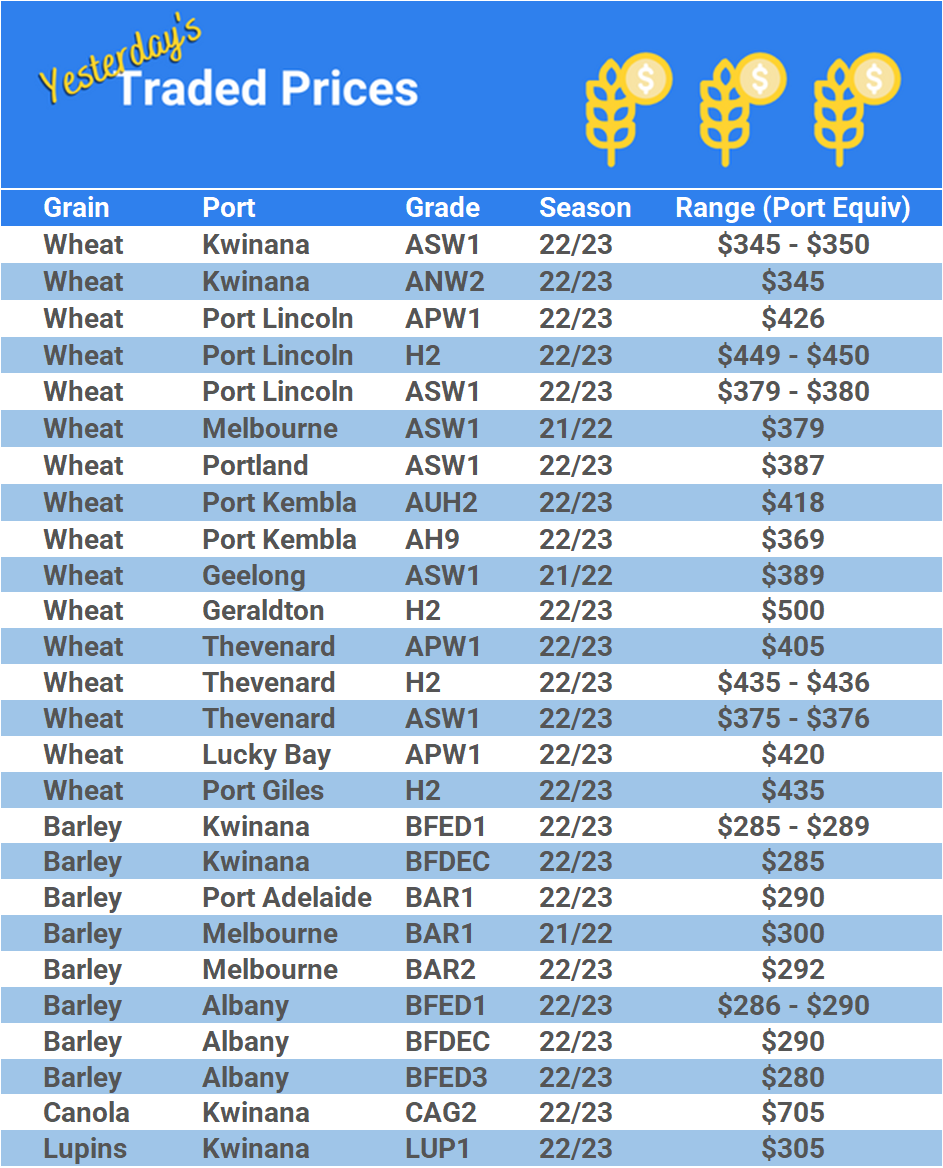

The wheat prices in Australia have been firming as the harvest progresses.

ASX Jan 23 wheat settled at $399 yesterday, which is back to the price it was at the start of December.

However, at the start of December, there was still a large concern regarding the crop quality on the East Coast, and the level of downgrade.

Reports are, the quality is not as bad as Hanrahan originally thought, which should be bearish milling wheat?

But milling wheat has firmed when it looks like we will produce more quality milling wheat? Why is this so, Professor Julius Sumner Miller?

Me thinks the grower is a reluctant seller, demanding more for their product to close that export parity gap. You go girl, your price destiny is in your hands and the hands of mother nature.

The other interesting thing in the market is the barley / SFW spread.

Globally SFW wheat and barley are around the same levels, USD $290 FOB (Free On Board), or $400 FIS (Free In Store) WA or $380 Track East Coast.

Because the quality downgrade is not as bad as first thought, SFW is getting closer to export parity. The Philippines business was done at an equivalent $410 Track level East Coast.

But SFW is currently trading $420 - $430 delivered Melbourne domestic markets,

Barley however is trading $50 under SFW wheat, which is wider than its nutritional spread, so it makes more sense to throw it into a cow’s ration.

However, forget about the cow, more importantly, SFW is around world market levels, give or take USD $30 pmt (per metric tonne), but barley is trading well under export values.

So, load the boats with barley as the export price differences are greater.

At USD $290 FOB for barley, this is around $380 Track Vic, yet the market is bidding $310 tops for feed barley.

There is a USD $30 difference when exporting SFW, and USD $70 exporting barley.

In the West, the ASW / feed barley spread is also USD $50 to $60 per tonne.

ASW export values, based on Russian values, or the bottom are around $450 FIS WA and barley is $400 FIS WA.

The difference to export ASW is USD $100 per tonne and margin to export barley is USD $110.

This is before we even dare to consider the Chinese 80% tariff being removed.

Hence for barley, hold don’t fold.

Most importantly we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments