Grain Report Thursday- 14th December

- Clear Grain Exchange

- Dec 14, 2023

- 2 min read

What price do you want for your grain?

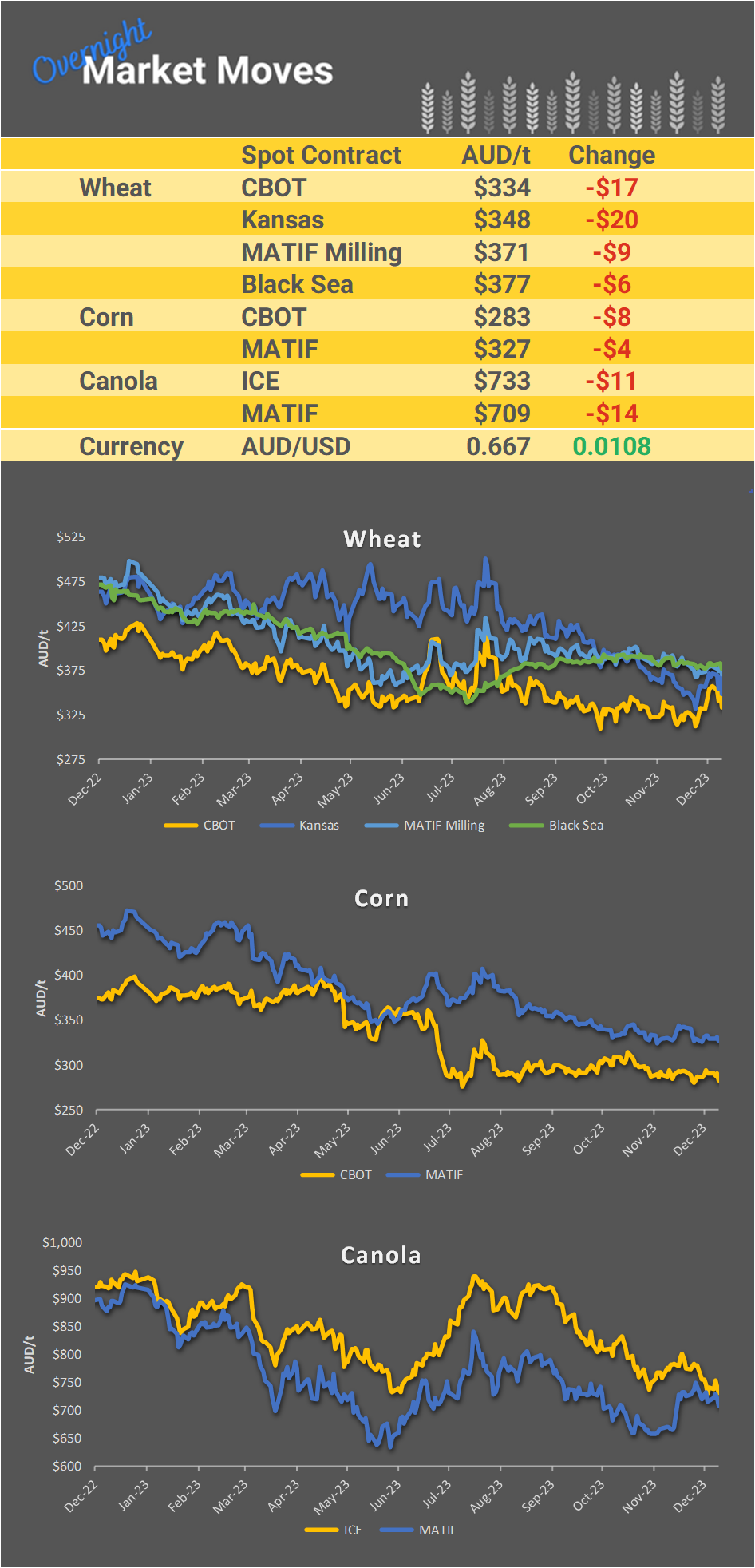

Overnight moves in international markets and yesterday's actual traded prices across Australia are below to help you determine your price. If you need to change your offer price, simply edit it before market open.

Look Out!

Welcome to the wheat market roller coaster; up strongly one night down sharply the next.

I wonder if the Chinese Xi Cricket Team will step back in on the dip and buy some more US wheat.

They could buy some of the Victorian ASW with current site bids around AUD $350 Track or USD $266 FOB.

WA ASW wheat traded at USD $286 FOB yesterday.

Freight from Geelong to China is USD $5 more than WA, so load the boats from Geelong as the market is trading at USD $15 under export parity.

The other thing that is happening on the East Coast is the ASW / APW spread, which has now widened to AUD $30 per tonne.

Once again, WA is a great example of where the world market values our ASW / APW spread, as WA exports most of its wheat to the world.

ASW is trading at a AUD $10 discount to APW in WA, which is where it usually trades.

In Wallaroo, the spread was AUD $5 yesterday.

So, why on earth would a farmer sell ASW in Victoria at a AUD $30 discount to APW, especially when we have a large domestic market.

Vic has a great crop with great yields. But as soon as someone says we have a big crop, panic sets in?

What are we going to do with all this wheat? Ahhh, sell sell, the sky is falling on our heads.

Last year Australia had a 39 million tonne crop, and we exported 32 million tonnes.

This year we have a 25 million tonne crop and will export 18 million tonnes.

And this year the stocks held by the major exporters is at least 10 million tonnes lower, so we have a tighter market.

Last week, our export values were quoted at USD $295 ex WA up USD $11 from the previous week, yet the East Coast market is softening on the back of a bit of rain up north, which is good for sorghum and provides a bit of feed.

But the rain doesn’t stop the boats, so the market doesn’t need to trade under parity, especially when we have limited export volume available this year.

Harvest does funny things to people.

To read more, subscribe to Outlook Commodities Morning Commentary

By subscribing to the Outlook Commodities Content you agree to CGX Subscriptions terms and conditions

CGX now own and operate the igrain market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au

Comments